Intergenerational wealth transmission and homeownership in Europe

2022 | Cohen Raviv & Thomas Hinz | Intergenerational wealth transmission and homeownership in Europe–a comparative perspective Abstract The literature on social and wealth inequality has long acknowledged the importance of intergenerational wealth transmission (IWT) to inequality in homeownership tenure. However, it has paid insufficient attention to the institutional structures that moderate these inequalities. Therefore, […]

Earth for all

2022 | Club of Rome | Earth for All: A Survival Guide for Humanity Earth4All published its findings in September 2022 in the form of a book that is currently available in English and German. Chinese, Japanese, Korean and Italian versions will be available soon. The book is a survival guide to help steer humanity […]

Global Wealth – BCG Report

09.06.2022 | Boston Consulting Group | Rise of 10.6% Is the Highest Annual Rate in More Than a Decade, Creating $26 Trillion in New Private Wealth, but Digital Leaders Threaten Traditional Players’ Dominance, According to a New BCG Report.

Nazi Billionaires

2022 | David de Jong | Nazi Billionaires. The Dark History of Germany’s Wealthiest Dynasties “Meticulously researched …compels us to confront the current-day legacy of these Nazi ties.” —Wall Street Journal A groundbreaking investigation of how the Nazis helped German tycoons make billions off the horrors of the Third Reich and World War II—and how […]

Jason Hickel: “It´s either degrowth for the rich or climate disaster”

24.04.2022 | Jason Hickel with Lukas Ondreka | Dissens Podcast | Economic antrhopologist Jason Hickel on capitalism, climate breakdown and a future for all.

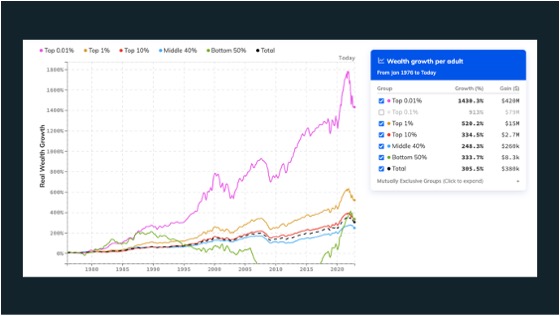

Realtime Inequality – Who benefits from Growth in the US?

2022 | Thomas Blanchet, Emmanuel Saez & Gabriel Zucman | Realtime Inequality – Who Benefits from Income and Wealth Growth in the United States? Realtime Inequality provides the first timely statistics on how economic growth is distributed across groups. When new growth numbers come out each quarter, the economists from Berekely show how each income […]

Impacts of poverty alleviation on national and global carbon emissions

14.02.2022 | Benedikt Bruckner, Klaus Hubacek, Yuli Shan, Honglin Zhong, Kuishuang Fenf | Nature Sustainability | Bruckner et al. show that carbon footprints can reach several hundred tons of CO2 per year, while the majority of people living below poverty lines have yearly carbon footprints of less than 1 tCO2. Lifting more than one billion people […]

Less is more

2021 | Jason Hickel | Less is more. How degrowth will save the world. The world has finally awoken to the reality of climate breakdown and ecological collapse. Now we must face up to its primary cause. Capitalism demands perpetual expansion, which is devastating the living world. There is only one solution that will lead […]

Inequality kills

17.01.2022 | Oxfam | The wealth of the world’s 10 richest men has doubled since the pandemic began. The incomes of 99% of humanity are worse off because of COVID-19. Widening economic, gender, and racial inequalities—as well as the inequality that exists between countries—are tearing our world apart. This is not by chance, but choice: […]

Millionaires for Humanity

Since 2021 | Djaffar Shalchi | Millionaires for Humanity advocates a wealth tax of 1% on multimillionaires to support the COVID-19 recovery, tackle poverty and climate change and achieve the UN Sustainable Development Goals. Research by the UN Sustainable Development Solutions Network highlighted the funding gap for the world to meet the Sustainable Development Goals […]