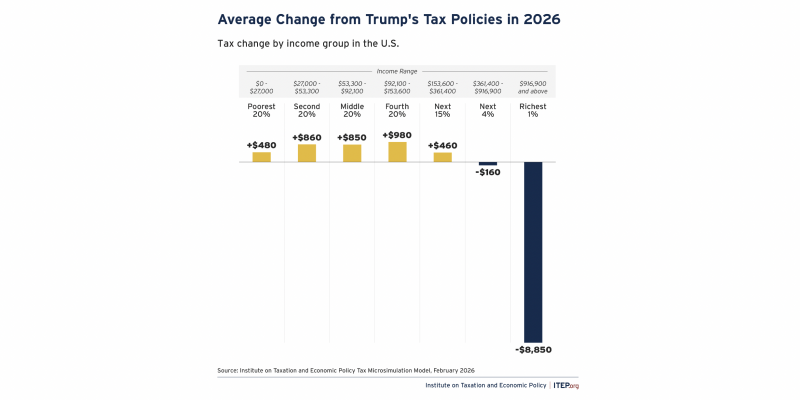

ITEP | Taking all the policies of President Trump and the Republican majority in Congress into account, all but the richest Americans are paying higher taxes on average in 2026 than they did last year.

Source: Institute on Taxation and Economic Policy.

CEPR | There have long been concerns that US Supreme Court decisions increasingly favour economic elites. This column analyses 1,782 cases from 1953 to 2022 to examine how justices’ rulings directly shift economic resources between the ‘rich’ and ‘poor’. In the 1950s, Democratic- and Republican-appo...

Tax Justice Network | The fourth session of negotiations on a world-first UN Framework Convention on International Tax Cooperation concluded last week in New York, bringing countries significantly closer to a consolidated zero draft ahead of the August negotiation session. Over eight days, governmen...

Tax Justice Network | Starbucks provides a great example of how the current global tax system is abused in order to shift profits from producer countries in the Global South to multinational corporations headquartered in the Global North. It also shows why the current UN Tax Convention negotiations...

Tax Justice Network | The International Chamber of Commerce has published, circulated among delegates, and promoted at a side event a report claiming that the global implementation of withholding taxes under Article 12AA of the UN Model would produce net losses for the global South.

The Tax Justic...

Stocktonia | In California, tech giants are warning that a proposed billionaire wealth tax will drive the ultra-rich out of the state. But historical examples suggest these fears often don’t materialize — most wealthy individuals stay put even after new taxes. As the debate heats up around a one-tim...